Introduction / Why is this article so important?

Managing personal finances has been one of the most overlooked challenges for Gen Z in today’s fast-paced economy. With the rising cost of living, inflation, intense workplace competition, changes in job markets, huge tax payments, layoffs, educational loans, and the pressure of being an independent member of society, Gen Z emerges as the most emotionally impacted generation. This article summarizes the major financial mistakes made by our generation based on insights from a survey we conducted and explores practical ways to mitigate these mistakes for a more secure, financially stable future.

Who are Gen Z?

Why is Gen Z also the most aware?

Though certain aspects might depict that Gen Z is not fully aware of the current market structure. However they are in fact, also the most informed generation. This generation has seen it all, whether it's the 2008 economic crisis, unprecedented natural disasters, or the COVID-19 pandemic crashing financial markets. Having seen it all, we believe Gen Z is well known for the uncertainty in the world economy. They are also cautious about the risks involved with financial markets.

Thanks to the rise in global internet and social media awareness, they are also very conscious of performing financial transactions. Because of social media, Gen Z knows more about investing at their age than any other previous generation. However, these are also the reasons why they are the most stressed ones, carrying the heavy weight about the job, long-term success, buying a home, taking care of family, not having enough money, artificial intelligence taking their jobs, recession, not being able to make correct financial choices, student debt, and inflation.

What do we understand by Finance?

Finance is generally the management of money and other assets. It is guided by human behaviors on how they acquire, utilize, save, and invest those assets. In short, Finance is how money is planned and managed. We all know the importance of money and responsible financial management. Financial management is something that every individual must possess for the smooth interaction of their daily financial activities. When it comes to Gen Z, financial management is something that has been undershadowed, as this generation confuses themselves to be someone well-informed and self-sufficient, but in reality, lacks a solid foundation in financial literacy.

Where are we lacking?

Our generation has been gifted with a significant financial transformation than the previous one. From the idea of piggy banks to investments in the share market, we have seen and experienced it all, which means old tricks for financial management are not relevant in today’s world. But, are we ready for such rapid financial transformation?

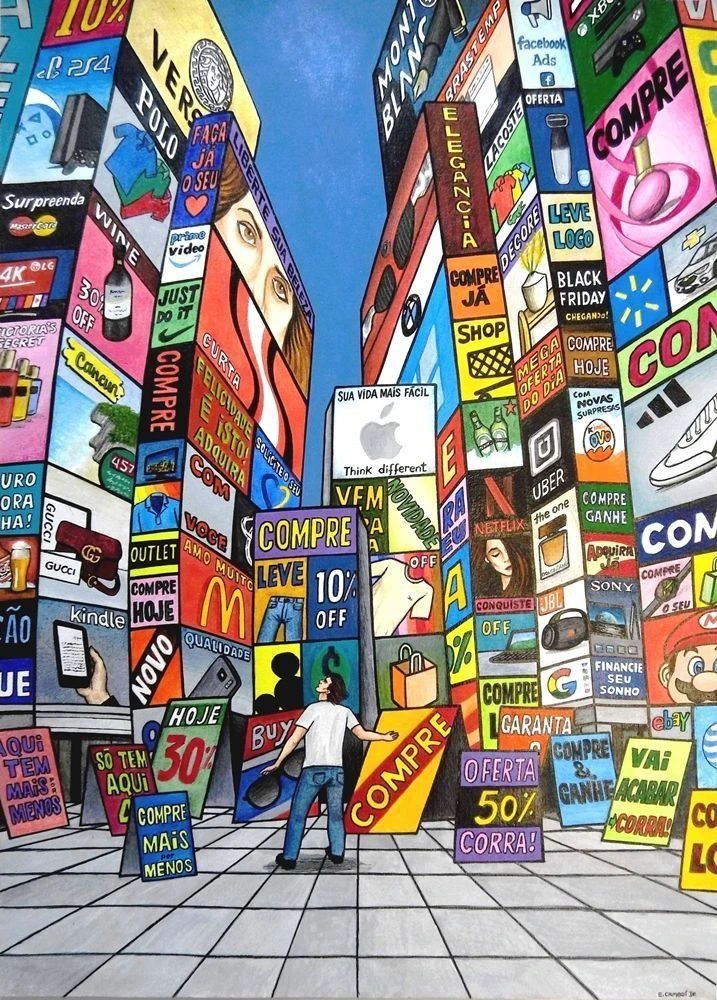

As a human beings, we prefer someone who validates our decisions than those who give us a reality check. Social comparison is a slow poison, and Gen Z is heavily driven by it. We are trying to change ourselves to maintain our image in others mind and spending on something that isn’t necessary to us. The pressure to keep up with the internet challenges, social media posts, wearing the perfect brands, and the urgency to shop more are the contributors driving us towards financial instability.

Furthermore, traits like the cashless effect are playing a significant role in promoting overspending. Where humans tend to be psychologically attached to tangible items, we feel distant when money goes away from us, and we try to spend less. But in today’s era, when everything has come together on a rectangular screen, we prefer convenience, without realizing this detachment from money. And it is leading us towards impulsive spending.

Additionally, non-eco-friendly trends like fast fashion have exposed us to buying more items than necessary. Reports suggest that the fashion industry already has an ample amount of dresses for the next three generations.

Although this era is highly advanced in terms of financial investment, like mutual funds, cryptocurrencies, the share market, and stocks. Gen Z feels the urgency to be financially secure faster, which, without proper financial literacy, exacerbates(exploits) their financial status. Since the investment platforms are increasing worldwide, they are also eager to invest because of FOMO (fear of missing out). According to the report of the Investopedia financial literacy survey 2022[2], 44% percent of Gen Z who are not investing say it’s because they don’t know where to start, and most Gen Z invest before the age of 21 because of FOMO.

As 23-year-old financial advisor Zechariah Schaefer, whose firm Ascent Personal Finance specializes in providing advice for millennial and Gen Z crypto investors, puts it, “They know lots of things about finance loosely, but they don’t know a lot of things deeply.”[2] With social pressures, overflow of financial information in social media, and the overwhelming weight of “what will people think?” spending money today feels like a highly confusing decision that affects more than just their wallets.

How can we manage finances?

Financial literacy is among the most important things that must be taught to the younger generation from a very young age. Preparing for a worse future crisis, risk-free saving accounts, investment accounts, side hustles, and old age accounts, learning about personal finance should be taught in schools, rather than pressuring them regarding financial literacy after they have completed their education and have already entered the job market.

-

Along with this, some of the practical steps that our generation can take are:

- Save more. Saving is the income for the future. The world is filled with obscurity, so wise saving in interest-generating accounts is the most important pillar.

- We ought to have more than our income. We should be focused on earning money from multiple income sources and not rely on a single one. Almost all the financially stable individuals across the world have multiple income-generating channels.

- Additionally, smart and strategic investing is adequate, but only with proper knowledge about those investing platforms and the guidance of a financial advisor.

- Furthermore, if you see any item and you wish to buy the item, wait for 24 hours before buying. It's called the 24-hour rule, which helps you reflect whether the item is a need or just another want. This prevents you from impulsive buying.

- Moreover, avoid lifestyle inflation. If your income has increased, do not increase your consumption proportionately. Instead, aim to increase your investments and savings.

- Learn to spend wisely. Your expenses should give you the potential of future earnings. Buy resources, tools, and skills that increase your ability and productivity to earn more. For example, read books, learn languages, engage in programs that expand your networks, and spend on buying online courses to increase your opportunities in high-demand areas like the tech field. And avoid superficial approaches to fashion, food or social media.

Conclusion